Condo Insurance in and around Dayton

Unlock great condo insurance in Dayton

Cover your home, wisely

Your Personal Property Needs Protection—and So Does Your Condo Unit.

Often, your retreat is where you are most able to unwind and enjoy the ones you love. That's one reason why your condo means so much to you.

Unlock great condo insurance in Dayton

Cover your home, wisely

Put Those Worries To Rest

You want to protect that unique place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as fire, vehicles or weight of ice or snow. Agent Richard Keller can help you figure out how much of this awesome coverage you need and create a policy that works for you.

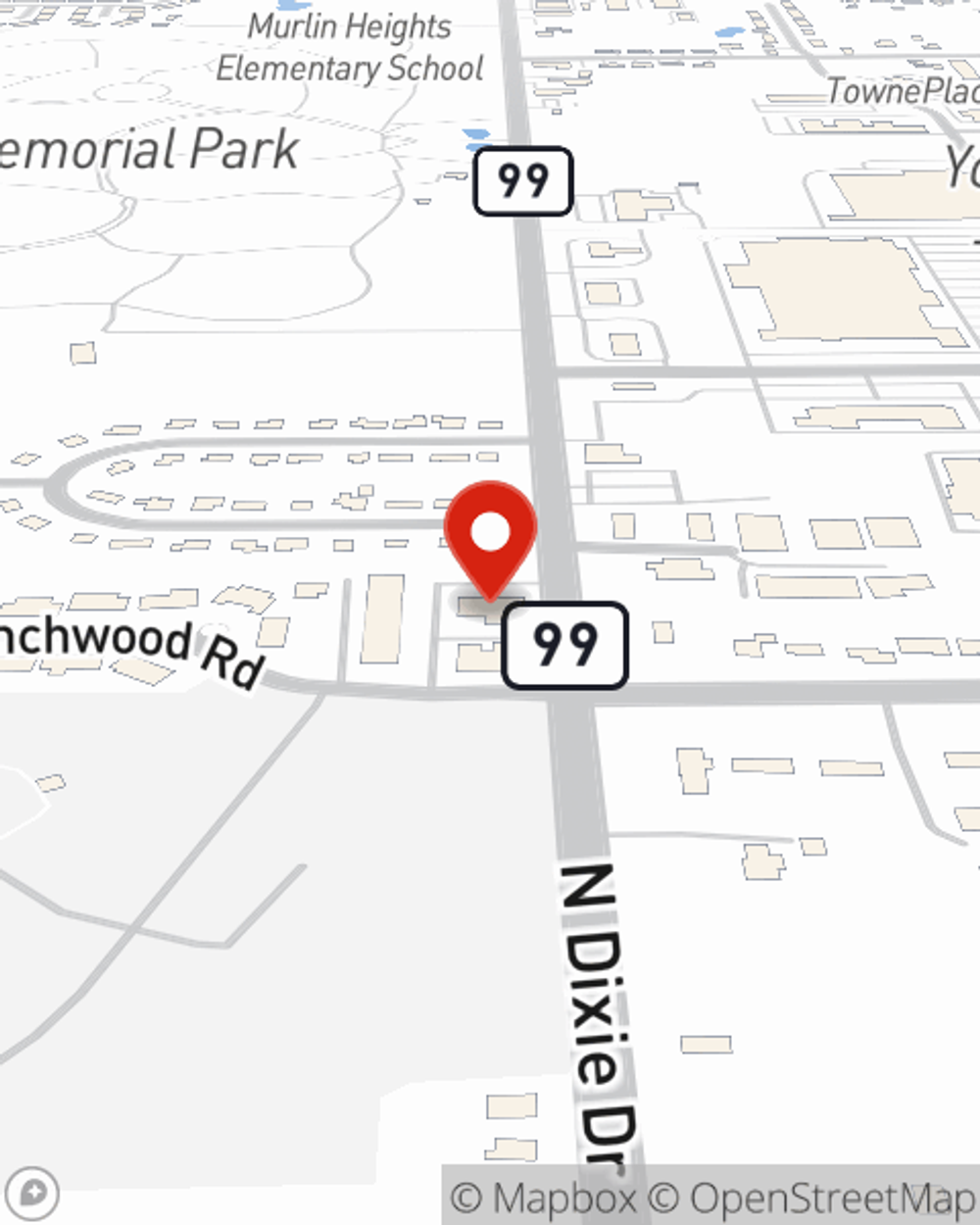

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Richard Keller's office today to find out how you can meet your needs with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Richard at (937) 890-2880 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Richard Keller

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.